- Homepage

- Home claims process

Home claims process

It only takes 5-10 minutes to file a claim in your online account. All that's needed is the approximate date of the incident and basic details of what happened. This simply starts the process and we'll contact you if more information is required.

We're here when you need us

Get the app

Manage your claim

Preferred contractors1

What's typically covered

Personal Property

- This pays the actual cash value of your damaged personal belongings, minus any deductible

Dwelling

- Helps cover you in the event of injury or property damage to somebody else

Personal Liability and Medical Payments to Others

- This helps provide protection if someone is injured or there is damage to their property

Other Coverages

- For more information about home insurance coverages, visit our home coverages page

How will my home damage be paid for?

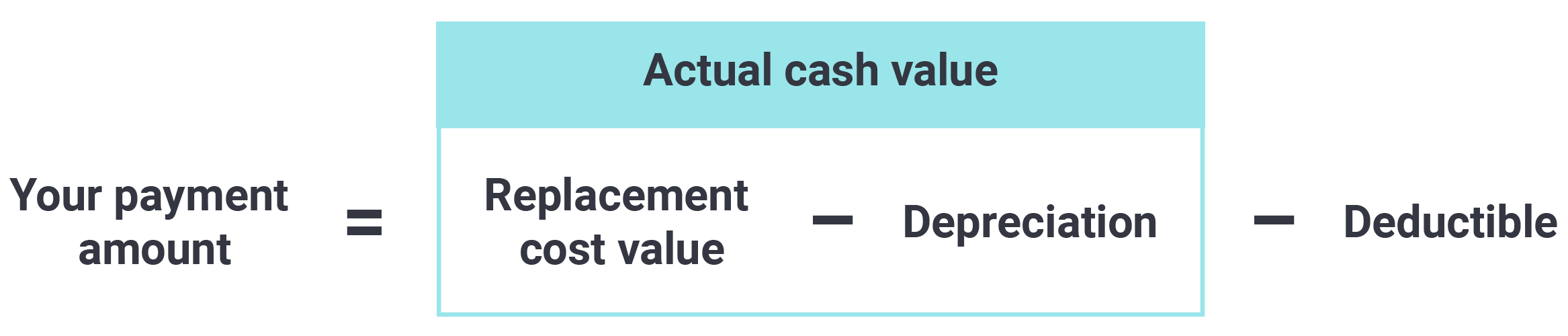

For a covered claim, you'll be paid the actual cash value of the property damaged minus your deductible1 (varies by policy/state). We calculate actual cash value by using the replacement cost less depreciation; however, additional payments may be made for policies with replacement cost coverage.

What you'll need to file your homeowners claim

In general, we may ask for:

- When and how the damage happened

- A list of damaged property including the make, model, age, and condition of each

- Photos of the damage

- Important documents like estimates, reports for experts (ex., plumbers), and receipts for any repairs completed

Why file online?

- File on your time: You can file online 24/7, with no holds or wait times

- Takes 10 minutes or less: We simplified the experience to get you back to your routine faster

- Track and manage everything: Easily track and manage your claim online, right from your phone

Understand the home claims process

Whether you file online or over the phone, we'll guide you through each step and let you know what information we need.

File a home claimAny damage to your home and/or injuries will need to be reviewed. In some cases, only photos are needed.

If possible, we'll complete a review of your home and personal belongings over the phone. Sometimes, we may need to come to your home to complete a thorough review of the damages.

You're responsible for paying your deductible amount toward your repairs. After that, we cover the rest of the cost, up to your chosen limits.

Get updates about your claim, as they happen, and move things along when you manage your claim online.

Check your claim statusDownload our app to file and manage your claim faster

Download our mobile app to file and manage your claim faster

- Easily file and track your claim

- Take damage photos for an estimate

- Call 24-Hour Roadside Assistance

- Make policy changes

- And more

Open the camera on your phone, hold it up to the QR code, and tap the link to download

- Easily file and track your claim

- Take damage photos for an estimate

- Call 24-Hour Roadside Assistance

- Make policy changes

- And more

Home claims frequently asked questions

You can easily track your claim through your online account at libertymutual.com/online-claims. You can also sign up to receive updates via text and email.

Your claims representative will review your policy with you and help you understand the coverage available for damages to your home and personal belongings.

Your policy has a deductible, but the amount can vary depending on your policy and type of loss. Your deductible is the amount you pay out-of-pocket toward repair or replacement costs, which, in most cases, you'll pay directly to your contractor.

If possible, we'll complete a review of your home and personal belongings over the phone, . In some instances, we may need to come to your home to complete a thorough review of the damages.

If we determine a 3rd party was legally at fault for your loss, subrogation is the process where we attempt to recover money paid on your claim from the at-fault party. Although we can't guarantee a recovery, we may be able to reimburse all or a portion of your deductible.

Your claims representative will ask you for a list of damaged personal belongings. Providing photos, receipts, or manuals for the items can help us estimate the cost of repairing or replacing them. You can easily submit this information at libertymutual.com/online-claims.

We can also help you replace certain items. For damaged items that only need to be cleaned, we have a restoration and/or dry-cleaning company that can take care of the cleaning for you. The restoration company may need to pack up your belongings and move them to their storage facility in order to clean them. Please don't dispose of any personal property items until we've authorized their disposal.

If there is coverage for your claim, our first check will pay the actual cash value of the property that was damaged minus any applicable deductible.2 The actual cash value is the cost of replacing or repairing an item today after subtracting the depreciation. If your policy has replacement cost coverage, you may receive additional payment after your repairs are completed.

- Your payment amount: The amount issued in your first check

- Replacement cost value: what it would cost to repair or replace the item at today's cost

- Depreciation: reduction of property value over time due to age, use, and condition of item

- Actual cash value: What you would pay to repair or replace the item at today's cost minus the depreciation

- Deductible: The amount you pay out-of-pocket toward repair costs

Once the repairs are completed or the items have been replaced, you'll need to submit proof of purchase or repairs (receipts or invoices). These can be uploaded to your online account. We'll then review them and send you a check for the applicable recoverable depreciation, or the amount of depreciation reimbursable based on our estimate of repairs and/or replacement costs.

If you experience damage to your home, please notify your mortgage company as soon as possible. If you have a mortgage loan, both you and your lender have a legal interest in your property and money at risk if your home is not repaired. If you have a mortgage on your home, we will likely put both your name and the name of your lender on the check to protect the financial interests of both parties.

Some important things to remember

- If your mortgage company is named on the claims check, they will need to endorse it by signing the back of the check

- Contact your mortgage company about releasing the funds for repairs to you

- Continue making your mortgage payments as usual

- If your mortgage company has changed or the name we have in our records isn't accurate, please contact Liberty Mutual at 800-225-2467.

Yes. Your claims representative can recommend a company through our preferred contractor1 network or you can search our preferred contractor1 lookup tool.

If your home is not livable during the repair process, your claims representative can help you find temporary housing and explain how we might cover additional living expenses.

You or your contractor should contact your claims representative immediately and hold off on making any new repairs until you speak to them. Depending on the nature of the damage, we may need to reinspect your home first. If we find that the additional damage is related to your claim, we'll update the repair estimate.

Your policy provides payment for the repair or replacement of damaged property with materials or items of a similar kind. We can't pay for the increased cost or any additional living expenses incurred as a result of any remodeling or upgrades, which may result in extended repair time. If you choose to upgrade your home, please coordinate with your contractor directly, at your own expense.

In addition to your claims representative, who will help you every step of the way, here are some resources for help during this difficult time

- Federal Emergency Management Agency: 800-621-FEMA (3362) or fema.gov

- American Red Cross: 800-RED-CROSS (733-2767) or redcross.org

- U.S. Small Business Administration: 800-659-2955 or sba.gov

- Insurance Institute for Business & Home Safety: disastersafety.org