- Car Insurance

- Auto Insurance by State

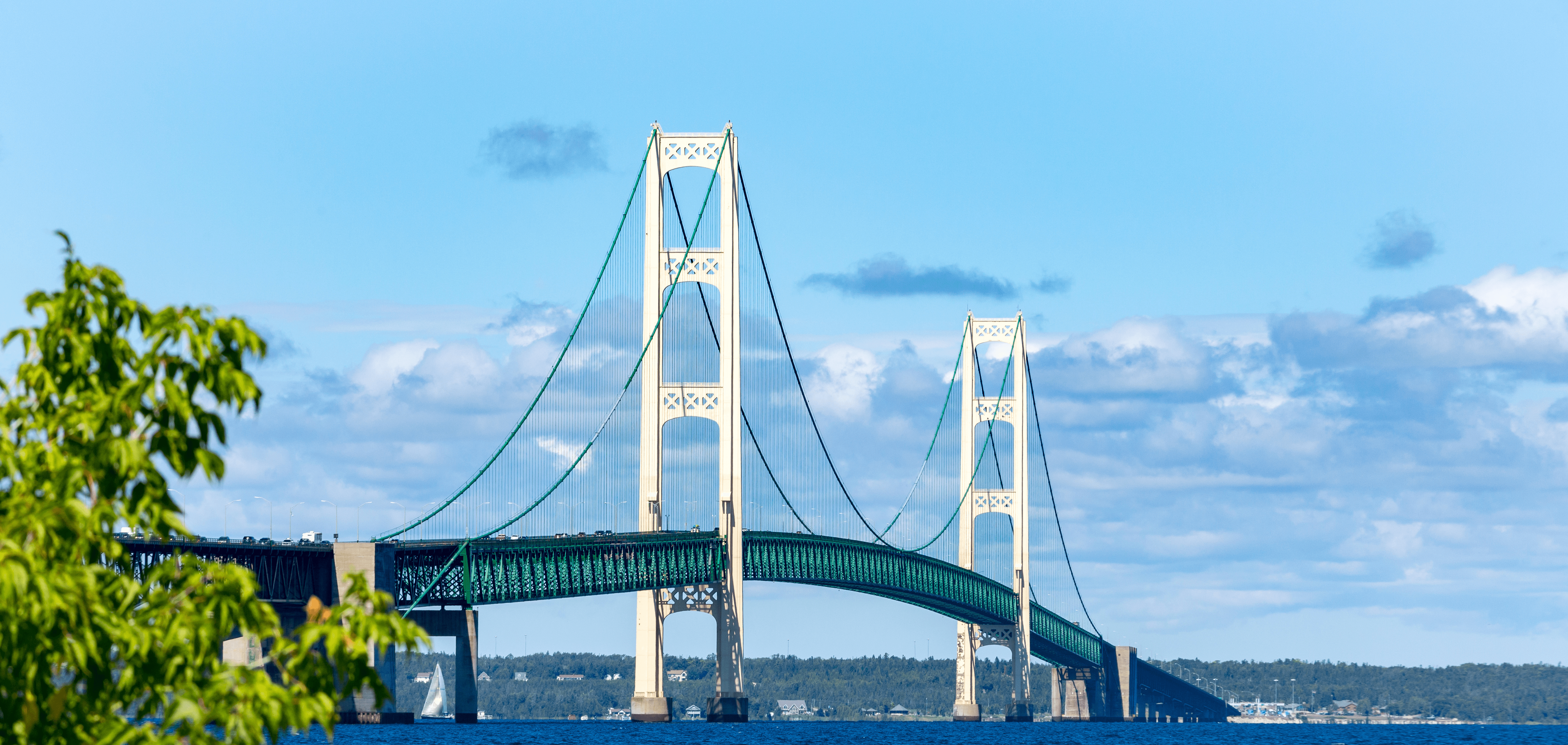

- Michigan Car Insurance

Michigan car insurance

Michigan Customers: Please note that effective July 1, 2023, the definition of 'Qualified Health Coverage' as it relates to Personal Injury Protection Medical Coverage has been updated per MI DIFS Bulletin 2023-12-INS. For policies issued or renewed effective July 1, 2023 and later, the new required deductible for 'Qualified Health Coverage' is $6,579 or less per individual (formerly $6,000 or less per individual).

Common questions about Michigan

auto insurance

What car insurance is required in Michigan?

In Michigan, it's illegal to drive without insurance. Drivers in Michigan are required to have car insurance coverage for

- Bodily Injury to others

- Property Damage Liability

- Uninsured Motorist Coverage Bodily Injury

Here are the minimum auto insurance limits drivers must have in Michigan.2

Coverage | Amount |

|---|---|

| Bodily Injury Coverage | $50,000 per person and $100,000 per accident |

| Property Damage Coverage | $10,000 per accident |

| Property Protection | $1 million |

| Personal Injury Protection | Minimum limit depends on qualified health coverage maintained by customer |

For more information, check out the Michigan's Department of Insurance and Financial Services.

What's the average cost of car insurance in Michigan?

The average cost of car insurance in Michigan was $2,6393 in 2021 according to thezebra.com. That's 73% higher than the national average. Of course, your auto insurance cost will depend on many different factors including your age, where you live, and your driving history.

Some people get the minimum coverage, while others prefer more protection. Liberty Mutual can save you money on Michigan auto insurance with a customized policy, so you only pay for what you need.

What Michigan car insurance coverage is right for you?

All Michigan drivers must have the state minimum auto insurance coverages. But, based on your budget and needs, you may want to consider higher limits for more protection. We'll help you customize your Michigan car insurance to get the coverage that fits you.

See all of our auto coverage options.

What's the best car insurance in Michigan?

Liberty Mutual knows that everyone has different needs for their Michigan auto insurance. Some may want the cheapest Michigan car insurance, while others want more coverage and an auto insurance company they know they can trust. We can help you customize your Michigan car insurance, so you only pay for what you need.

Who has the cheapest car insurance in Michigan?

Getting the cheapest car insurance in Michigan may sound great, but that cheap rate can come at a cost when you need it most. You want auto insurance that's affordable, but even more importantly — reliable, in case you have an accident.

A Liberty Mutual auto insurance policy can cost less than you think.4

- $817 lower than GEICO

- $731 lower than Progressive

- $839 lower than State Farm

- $758 lower than Allstate

Save money with these auto insurance discounts

Great drivers are made, not born. You'll get a discount if your driving history is violation-free.6

Learn more about SavingsThe more cars you insure with Liberty Mutual, the more you can save on your premium.6

Learn about Multi-Car Discounts and moreInstantly receive a 10% discount when you enroll. Complete the program and you could save up to 30% on your policy for safe driving behavior.7

Save with our safe driver program